タトゥー・刺青の完全除去なら美容外科に相談しましょう

刺青・タトゥーを完璧に消すなら美容外科での皮膚切除しかありません!

あなたは今、若い時に入れた刺青・タトゥーを消したいと思っていますよね?

![]() 就職活動に支障が出る

就職活動に支障が出る

![]() 結婚式でドレスが着れない

結婚式でドレスが着れない

![]() 結婚を控え、相手のご両親に会う前に刺青をなくしたい

結婚を控え、相手のご両親に会う前に刺青をなくしたい

![]() 子供と一緒にプールに行けない

子供と一緒にプールに行けない

![]() 生命保険に加入できない

生命保険に加入できない

![]() 刺青のデザインが古臭く、恥ずかしい

刺青のデザインが古臭く、恥ずかしい

![]() 結婚前に昔の恋人の名前を消したい…

結婚前に昔の恋人の名前を消したい…

![]() 物心ついた子供にみられたくない

物心ついた子供にみられたくない

社会的に虐げられるだけでなく、実際に健康被害がある場合があります。

・C型肝炎に感染するリスク

・HIVに感染するリスク

・インク中の重金属により肝臓に負荷がかかり肝機能障害になる

・MRI検査が受けられない

・ガンになっても入院を拒否される場合がある

刺青・Tatooを入れた時は思いもつかなかったことに直面しているのではありませんか?

温泉やプールならば「ファンデーションテープ」という肌色のテ−プで隠すという

方法もあります。

でもそれはあくまで「一時しのぎ」でしかありません。

刺青をどうにかしたいのならば「隠す」か「消すか」しかありません。

そして、「消す」にはお医者さんへ行くしかないのです。

しかも普通の皮膚科などでは相談にものってくれないので、美容外科・美容皮膚科に行きましょう。

刺青を消す決断をしたあなたには栄セントラルクリニックをおすすめします。

一般に刺青の除去には2通りあります。

切除・縫縮

刺青部分の皮膚を切除し、周囲の皮膚を縫い合わせる方法です。比較的小さ目の刺青に向いています。

剥削

皮膚の表面を専用の機器で削り取る方法です。切除できない広範囲の刺青に向いています。

植皮

ご自身の太ももやお尻など目立たない部分から切り取った皮膚を移植することで、刺青の部分にかぶせる方法です。

広範囲の刺青に向いています。

栄セントラルクリニック

こちらをクリック

↓ ↓ ↓

聖心美容クリニック

事前のカウンセリングが丁寧だと評判です。

こちらをクリック

↓ ↓ ↓

リストカット・アームカット跡を消したいなら銀座よしえクリニックへ

銀座よしえクリニックなら、あなたのリスカ痕・アムカ痕をきれいに消してくれます。

思春期にリストカットやアームカットを繰り返したあなたの腕には傷跡がたくさん残っていると思います。

それは色白の場合だと特に目立ってしまいますよね。

自傷行為の傷跡というのは、普通の人は見たことがありません。

初めて見る人はあなたに聞くでしょう。

「うわ、どうしたのそれ?」

そして、リストカット・アームカット跡だと分かると「....」と絶句してドン引きです。

だからといって傷痕を隠すために夏でも長袖を着たりするのは、できればやめにしたいでしょう。

自傷行為の痕を消す方法は大きく分けて4つあります。

1.傷あとを隠すシート

2.塗り薬

3.形成手術

4.レーザー治療

傷あとを隠すシート

肌かくしーと

色選びの目安 : ピンクナチュラルは白人さんのような肌用 イエローナチュラルは色白さん用 ナチュラルは普通肌用 ダークオークルは小麦肌用

「タトゥー・濃い傷あと隠し用」と「傷あと・あざ隠し用」の違い : 「タトゥー・濃い傷あと隠し用」のほうがカバー力が高いです。(より隠せます。)

ファンデーションテープ (傷跡を隠すテープ)

色は タンオークル、オークル、ベージュオークル、ピンクオークル の4種類

数量:お試しセット(各色1枚ずつ計4枚入)

まずはお試しセットであなたに合う色をチェックしてみましょう。

塗り薬

塗り薬で有名なのは小林製薬の「アットノン」です。

保湿や血行促進などにより赤くなったケロイドの赤みを取って目立たなくするものです。

即効性があるものではないので月単位での使用が必要になります。

ケロコートという塗り薬も人気があります。

もりあがった傷痕をシリコンでカバーして圧迫し、傷痕を平らにします。

これも数カ月は使い続けなければなりませんね。

スカージェルは玉ねぎに含まれるアラントインという成分を配合し、傷跡を柔らかくして

なめらかにすることで傷あとを目立たなくするものです。

ヒルドイドジェルはヘパリン類似物質であるムコ多糖体多硫酸エステルの働きにより、

皮膚の乾燥を防ぎ血行をよくする塗り薬です。ケロイドの治療と予防にも使用されています。

形成術

形成術は傷痕の残る皮膚を切り取って縫い合わせる手術です。

リスカの痕は消えるかもしれませんが縫い合わせた痕は残るのであまりオススメできません。

レーザー治療

レーザー治療に関しては、各美容外科が独自のレーザー治療を行っています。

レーザー治療ならば塗り薬にくらべてはるかに短時間で結果が出ますし、

お医者さんがやってくれるのでやっぱり安心感が違います。

その中でも「Quanta フラクショナルレーザー」という治療機を使っている銀座よしえクリニックがおすすめです。

リストカットなどの自傷行為に対する理解のある病院というのは実はあまり多くはありません。

もちろんリストカット直後の出血している時はどんな病院のお医者さんでも全力で治療してくれます。

しかしその傷痕を消そうとする場合は病気でも怪我でもないので普通の皮膚科に行っても相手にされない場合がほとんどです。

銀座よしえクリニックなら、こうした治療を専門にしていますので

温かく迎えてくれますし、リストカット跡も目立たないようにしてくれます。

傷跡に効果のあるレーザー治療器として有名なものに「スターラックス1540」というものがあります。

お肌の生まれ変わり(再生)を行い、同時にリフトアップ(引き締め)を行いますので、

毛穴の凸凹やキズ跡の盛り上がりがキレイになるだけではなく、赤ちゃんのようなプルプルお肌となるのが特徴です。

しかしそのスターラックス1540よりも高性能なのが「Quanta フラクショナルレーザー」です。

スターラックスのレーザー波長 1540nm に加え、10600nm の波長のレーザーも同時に照射できるのです。

そのため、「大きな効果、小さなダウンタイム」が期待できます。

リスカやアムカの傷あとが消えたら

さあ、勇気を出して銀座よしえクリニックへ行ってみましょう

これからもリストカット跡を隠し続けてビクビクしながら生活するより、多少費用がかかっても

きっちり治してリストカットをしていた過去を払拭しましょう。

公式ページはこちらをクリック

↓ ↓ ↓

銀座よしえクリニック

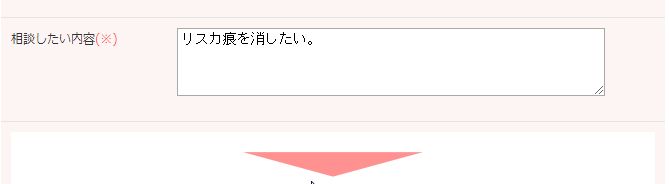

相談欄に「リスカ痕を消したい」と書きましょう。